NEWS

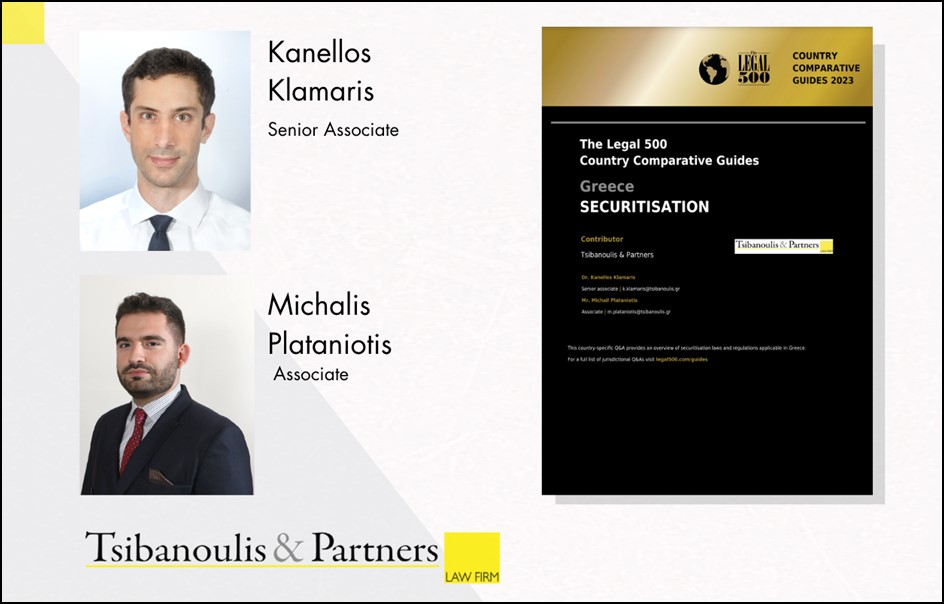

T&P contributes Greece Chapter to The Legal 500 Comparative Guides – Securitization 2023

Co-authored by T&P’s Dr. Kanellos Klamaris and Michail Plataniotis.

We are pleased to share that Tsibanoulis & Partners (“T&P”) has contributed the Greece Chapter in The Legal 500 Comparative Guides – Securitization 2023. Dr. Kanellos Klamaris, Senior Associate and Michail Plataniotis, Associate have co-authored the Chapter.

The Chapter provides an in-depth guide to general legal and regulatory issues typically relevant to securitization transactions in the Greek jurisdiction.

In light of the recent regulatory developments and taking into consideration the complexity of the applicable legal framework, as well as the increasing cross-border nature of securitization transactions, we are of the view that in-depth knowledge of securitization laws and regulations, coupled with expertise and experience in typical securitization structures, is vital to structure legally compliant and successful transactions to the benefit of all parties involved therein.

“So far, Securitization has been utilized in the Greek market as a credit risk transfer mechanism, focusing mainly on NPL Securitization transactions,” said Mr. Plataniotis.

Greek law enabled securitizations for the private sector in 2003. However, it was only during and after Greece’s economic crisis (roughly 2009 -2018) that securitizations transactions gained in significance.

“This was owed to the fact that during the economic crisis, the Greek legal framework was supplemented by two special laws regarding the management of NPLs by Servicers as well as the provision of state guarantees to the senior tranches of particular securitization transactions,” said Dr. Kanellos Klamaris.

The combination of those measures resulted to the reduction of the percentage of NPLs by more than 85% in comparison to 2016, when the NPL-percentage and total amount reached its peak. At the time, T&P drafted legal opinions on the assessment of the legal risk associated with the securitization transactions entered into by several Greek major credit institutions.

“Our legal opinions helped the credit rating agency involved to proceed with their assessment of the bonds issued in the context of the securitization transactions. We are proud to have contributed to the solution of an important issue to the benefit of the Greek economy,” said Dr. Klamaris.

Securitization, however, is far more than a mere risk transfer mechanism. It can serve as a funding mechanism for financial institutions or even SMEs.

“It is vital to further revive the Greek Securitization market in this direction, especially in the context of the simple transparent and standardized (STS) label and STS on-balance-sheet synthetic securitizations,” said Mr. Plataniotis.

“Furthermore, the Greek Securitization market must keep up with the EU sustainable securitization market developments,” he added.

T&P’s Banking and Finance experts provide consistent, high quality legal advice in an efficient manner to all market participants.

The #Greece Chapter is available to read here